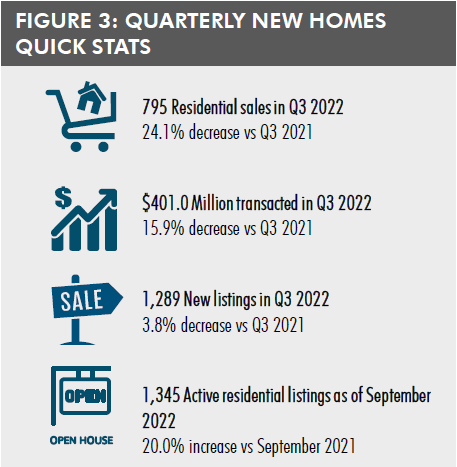

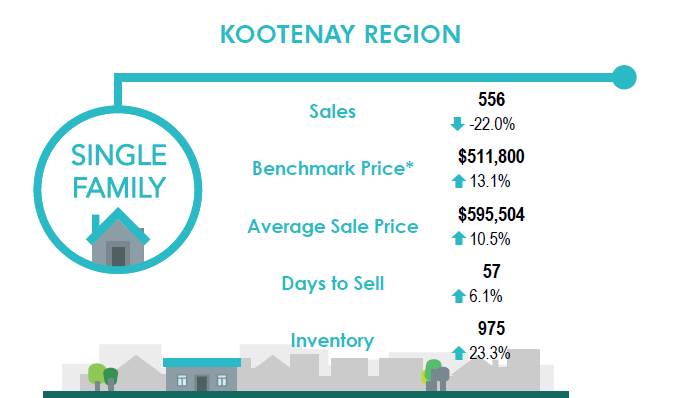

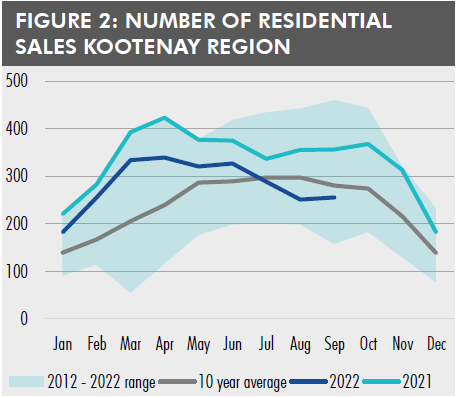

The Kootenay region real estate market has seen a noticeable decline in activity amid rising interest rates. Despite this, the region is doing markedly better than other parts of BC. There were 795 residential sales, worth $401.0 million, in the third quarter of 2022. This represents a 24.1% decline in the number of transactions compared to the same period last year. Sales were below the 10-year average for the entire quarter, with transaction levels similar to those seen in 2015. It is important to note that the decline in sales appears worse than it is because it is being compared to the extreme highs seen during the pandemic, when the market was at its historic hottest. Additionally, many transactions which would have happened in the later part of 2022 were pulled forward earlier in the year as interest rates were near record lows. Furthermore, pricing has remained stable without much change, seeing are turn to fundamentals. The composite benchmark price for the region declined 3.6% from peak prices in July of 2022, while on a month-over-month basis prices have declined 1.6% between August and September 2022.

Headline inflation appears to have peaked at 8.1% in June 2022. Rising prices slowed down for the third month in a row, experiencing moderate decline in September. Yet the rate continues to be red hot at 6.9% compared to 7.0% in August. Moreover, inflation remains well above the Bank of Canada’s 2.0% target. As a result, today’s numbers are unlikely to change the Bank of Canada’s stance regarding the need for additional interest rate hikes aimed at reducing inflationary pressures. Forward guidance has been clear in stating that policymakers will push for even higher rates over a longer period. The Bank of Canada increased its target rate by 75 basis points on September 7, which lifted policy interest rates into restrictive territory. Additionally, most economist expect the Central Bank to push ahead with at least another 50 basis point interest rate hike on October 26, 2022.

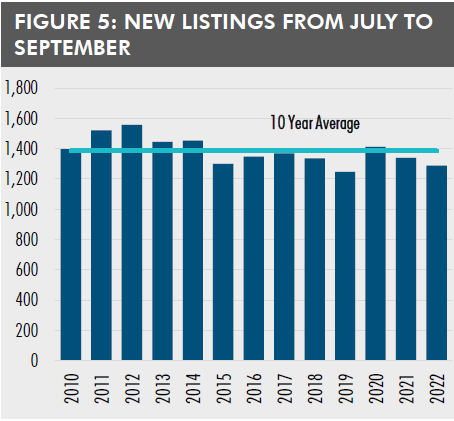

The region has seen a slight uptick in the number of properties available for sale in the third quarter of 2022. There were 1,345 active listings as of September 2022 this represents a 20.0% increase compared to the same period last year. This increase in supply is not due to a rise in new listings or an increase in fire sales. In fact, Q3 2022 experienced a decline of 3.8% in the number of listings hitting the market compared to the same period in 2021. The inventory build out is due to the strong decline in sales. Even with this increased inventory, the region is still chronically under supplied. Inventory levels continue to be well below pre pandemic levels. As a popular retirement community, many homeowners are now in what they consider to be their final home. There is little need to move, and many do not have a mortgage.

The area’s rural mountain topography also makes development of new supply costly. Furthermore, some of the decline in activity can be

attributed to lack of product, as limited inventory exacerbates low sales as there is not much incentive to sell. A growing divide is being

seen between buyers and sellers, as the gap between each parties’ expectations is wider than ever Sellers are having a hard time accepting that the market is changing and what they could have gotten for their house a couple of months ago is no longer viable. Buyers are not willing to offer at full price with the current state of inflation and rising rates.

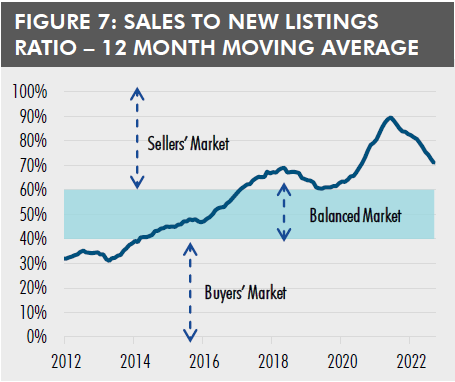

Despite decreased activity, the Kootenays continues to be a seller’s market. However, the region is experiencing stratification, where levels

of interest vary greatly depending on property prices. The luxury home market continues to be somewhat unspoiled by interest rate hikes. Higher end properties are selling, especially if they are waterfront, as wealthier buyers are less concerned with high interest rates. Good homes in good locations that are appropriately priced also continue to transact. Affordability is key in the current market environment. Listings under $400,000 still have a lot of traction and even see bidding wars over asking, as younger and middle income groups are finding themselves out priced. The impact of rising interest rates has been felt more acutely in the mid range segment of the market where homes between $600,000 and $1,000,000 dollars are experiencing a noticeable slowdown in activity.

The local economy is going strong into the end of the year. A 9.5% million treatment centre just broke ground and is scheduled to be

completed late 2023. A 102 unit residential building has just been approved for financing at Red Mountain resort. A future housing

development could be in the works if a former commercial property is approved for rezoning near Panorama. The Kootenay Farms Food Hub

and Innovation Centre is creating new opportunities for farmers and adds to the region’s food security.

The area is known for making it through market downturns better than others with affordability insulating the Kootenays from a stronger

freeze in activity due to rising interest rates. This region remains cheaper than other parts of the province. Homeowners and new buyers

who have been priced out of likeminded communities such as Squamish or the Island are attracted to the region’s similarity and lower prices. Buyers from Eastern Canada, Vancouver and the US drawn to the mountain town appeal are still shopping around as well. On top of that, people who are locked into a mortgage rate are rushing to find a suitable home in a region where supply is historically low, amid rising interest rates.