How the Trade War Affects BC Real Estate

Recent warnings from Bank of Canada Governor Tiff Macklem highlight potential challenges:

- Higher Costs for Buyers & Builders – Tariffs on building materials could increase home construction costs.

- Mortgage Rate Uncertainty – Inflation concerns may limit future interest rate cuts.

- Shifting Investment Trends – Investors may look for stability outside major urban centers.

- Increased Demand for Rural Living – Affordability and self-sufficiency are becoming top priorities for homebuyers.

Why Creston Stands Out

Unlike expensive urban markets, Creston offers homebuyers and investors a rare combination of affordability, quality of life, and self-sufficient living opportunities. With food prices expected to rise due to supply chain disruptions, having land to grow your own food isn’t just a bonus—it’s a financial advantage.

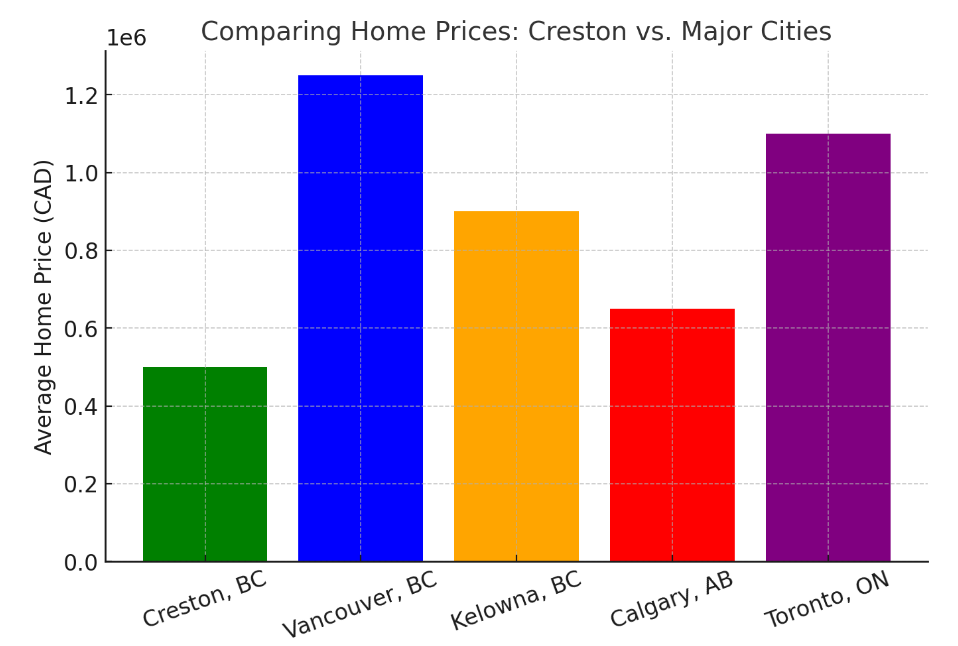

🏡 Affordable Housing – The cost of homes in Creston is significantly lower than in cities like Vancouver, Kelowna, and Toronto. Check out this housing cost comparison:

🌱 Fertile Land for Self-Sufficiency – Creston’s rich soil and mild climate make it ideal for growing your own food, from fruits and vegetables to nuts and grapes.

👨👩👧👦 A Better Place to Raise a Family – A tight-knit, friendly community with fresh air, outdoor activities, and a safe environment for children to grow and thrive.

💡 Lower Cost of Living – Creston offers reduced living expenses, and an overall more budget-friendly lifestyle compared to major cities.

🚗 Escape the Rat Race Without Sacrificing Convenience – While Creston feels like a peaceful retreat, it’s still well-connected with essential amenities, a regional airport, and access to larger centers when needed. Located on the Canada USA Border for streamlined international trade.

Is Now the Right Time to Buy in Creston?

With uncertainty in the broader market, Creston offers a rare combination of security, value, and long-term benefits for buyers, sellers, and investors. Whether you’re looking for a home to raise your family, a property to become more self-sufficient, or an investment opportunity in a stable market, Creston is a smart choice.

🏡 Thinking about making the move? Let’s chat! Whether you’re buying, selling, or investing, I’m here to help you navigate the Creston real estate market.

📞 Call/text Diana Klejne at 604-789-8202 or email DianaKlejne@Gmail.com to get started today!

#CrestonBC #AffordableLiving #MoveToCreston #GrowYourOwnFood #RealEstateInvesting #EscapeTheCity #SmallTownLife #KootenayLiving