Canada’s banking regulator, the Office of the Superintendent ff Financial Institutions (OSFI), has announced a key change to mortgage-financing rules, which will no longer require borrowers with uninsured mortgages to undergo a stress test when switching lenders at renewal. This policy shift is intended to provide homeowners with more flexibility and better options when renegotiating mortgage terms, particularly as they seek to secure competitive rates.

The stress test, introduced in 2018, was originally aimed at ensuring that borrowers could afford rising interest rates by requiring them to prove they could handle a 2% increase in mortgage rates. However, OSFI noted that the risks this rule sought to mitigate have not significantly materialized. This decision follows feedback from the mortgage industry, which highlighted an imbalance between insured and uninsured mortgage renewals.

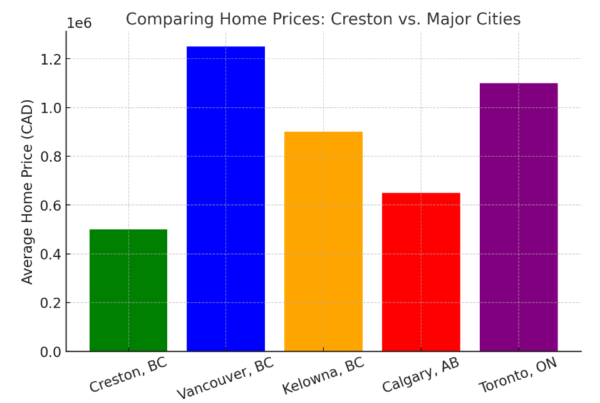

This change is part of broader amendments to Canada’s mortgage regulations, including a recent federal government policy allowing 30-year amortizations for first-time buyers and raising the cap on insured mortgages to $1.5 million. These adjustments are seen as a response to ongoing affordability challenges in Canada’s housing market and are expected to give the housing market a boost

See Full Article Here MPA Magazine

Your Next Steps

For those in Creston and the surrounding areas, Diana Klejne is here to guide you through these ever-changing market conditions. Whether you’re buying or selling, we’ll help you navigate the local real estate landscape with expertise and care.

Want more tips on selling your home faster and for top dollar or to schedule your Free Market Evaluation?

Contact Diana today! 604-789-8202 Email: [email protected]